Fincover serves as a dynamic hub connecting borrowers and lenders, investors, and businesses, providing a seamless avenue for finding the perfect financial product.

Fincover App: Reshaping Finances with Cutting-Edge AI Innovation

We are living in an era where technological advancements redefine the landscape of every industry. Financial sector is no immune to this technological revolution. The launch of Fincover app on Android Platform, a cutting-edge financial marketplace app, is poised to revolutionize the way finance is being handled. Packed with innovative features and capabilities, this app is set to become the go-to platform for individuals seeking a seamless and empowered financial experience.

Fincover.com, an online financial marketplace, commenced operations in 2020. It is a one-stop platform where people can buy loans, insurance, and investment schemes. Fincover has grown from strength to strength in these three years with 3 branches all over South India and 300+ employee headcount. Fincover serves as a dynamic hub connecting borrowers and lenders, investors, and businesses, providing a seamless avenue for finding the perfect financial product. Now they are all set to move ahead to the next stage with the launch of their mobile app.

ADVERTISEMENT

Gurumoorthy, Co-founder of Fincover.com “Our objective is to democratise wealth creation and give every citizen of our country access to create ways to build wealth. There is a wide gap between traditional banking companies and end customers, we aim to fill that gap and spread financial literacy among the masses".

Since their inception, they have distributed over Rs. 500 crores personal loan, handled wealth management worth Rs. 750 crores, and have collected Rs. 250 crores in Insurance premium. Now, they are all set to make a giant leap with the launch of their FinCover mobile app, in the first quarter of 2024.

Naresh Rajaram, Co-founder of Fincover.com, who is the CTO heading over the app development, says, " Fincover app is built to empower people financially. The design and features and functionality are top notch yet simple. The product is easy to use, and users can learn about the products available with a few taps"

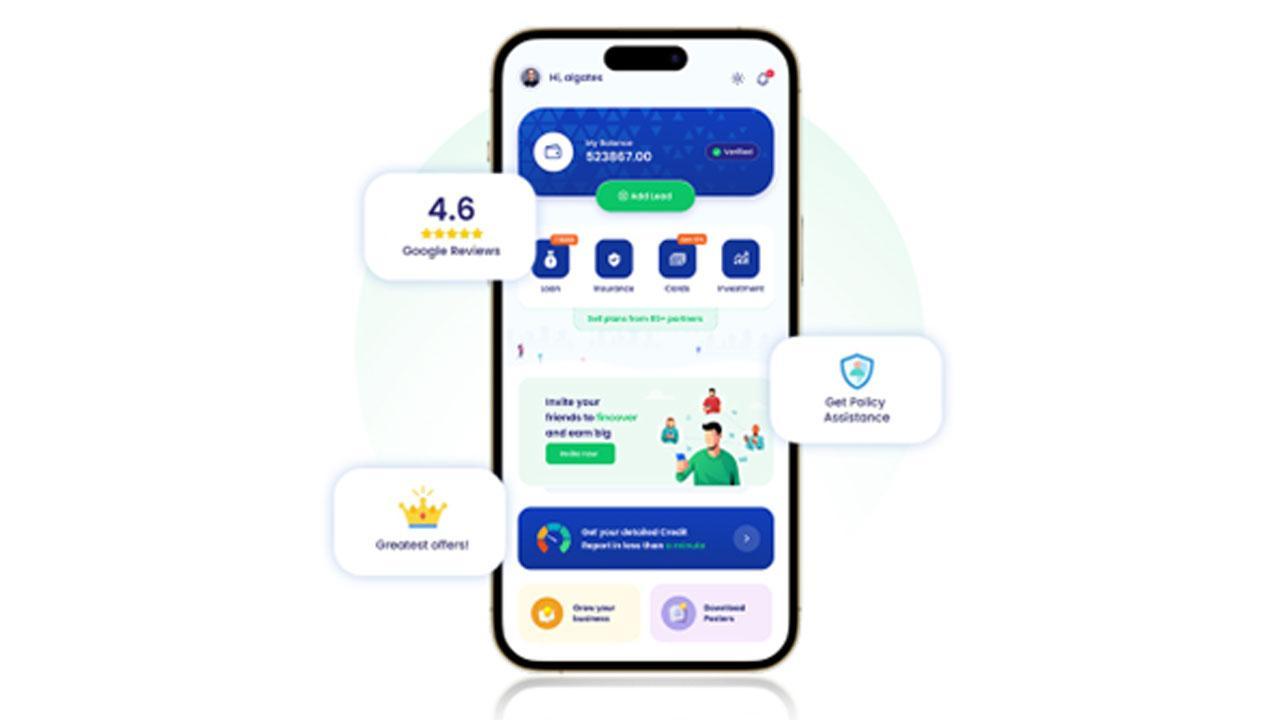

According to Naresh, Fincover will provide a full suite of Finance experience along with intuitive cutting edge technology on the platform, combined with AI and ML to make decision making easy. All the user need to do is provide a few details, their advanced algorithms, throws the best match to their requirements making decision making easy for the customers. And he promises the app won’t consume much memory and would be light on the device. The app seamlessly integrates powerful tools and features that empower users to take control of their financial destiny. Talking about the features, Naresh lists out a set of features that will redefine the way you manage your finances

Holistic view

Fincover provides users with a holistic view of their financial landscape by aggregating data from various providers, including savings accounts, credit cards, investments, loans, and insurance. This consolidated overview enables users to have a clear and real-time understanding of their financial health. Based on the inputs, the users can identify areas that need improvement and bolster their financial health accordingly.

Intuitive User Interface:

Fincover boasts an intuitive and user-friendly interface that will appeal to both novice and experienced financial professionals. The sleek design of the mobile app ensures a smooth navigation experience, making financial management a breeze.

AI-powered investment decisions

Harnessing the power of artificial intelligence, Fincover app provides personalized investment recommendations based on users' financial goals, risk tolerance, and market trends. This feature enables users to make informed decisions with confidence.

Security and protection

Security is paramount in the financial world, and Fincover takes it seriously. With advanced encryption, multi-factor authentication, and biometric security features, users can trust that their financial data is protected at all times

Credit Score Monitoring

Stay on top of your credit health by regularly monitoring your credit score within the app. Fincover cover app provides insights into factors affecting your score and offers personalized tips to help you improve and maintain a healthy credit profile.

Conclusion:

With its groundbreaking features and capabilities, Fincover app is set to redefine the financial marketplace. The founders say the beta version would be out anytime and a full-scale launch would definitely happen within the first quarter. Stay tuned for the launch and embark on a new era of financial management with Fincover app

Source - https://www.fincover.com/

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!